BTC Price Prediction: Bullish Technicals Meet Volatile Fundamentals

#BTC

BTC Price Prediction

BTC Technical Analysis: July 2025 Outlook

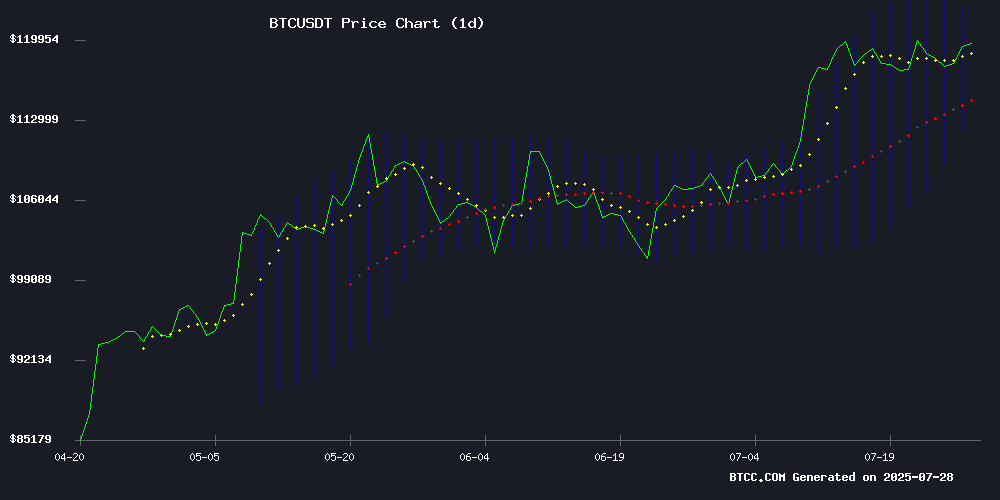

According to BTCC financial analyst John, BTC is currently trading at 118,058.39 USDT, slightly above its 20-day moving average of 117,857.78. The MACD indicator shows a bullish crossover with the histogram at 2,120.01, suggesting potential upward momentum. Bollinger Bands indicate a neutral to slightly bullish stance, with the price hovering NEAR the middle band. John notes, 'The technical setup favors a consolidation phase with a bias toward testing the upper Bollinger Band at 121,433.60 if buying pressure sustains.'

Market Sentiment: Mixed Signals Amid Institutional Moves

BTCC analyst John highlights conflicting signals from recent news: 'While PayPal's crypto payment expansion and Metaplanet's doubled BTC holdings are bullish, MicroStrategy's pause on purchases and whale selling pressure create short-term uncertainty.' He adds, 'Institutional interest (e.g., Sequans' $88.5M purchase) and mining sector growth (MARA's $900M raise) provide fundamental support, but traders should monitor the 80,000 BTC whale sale impact.'

Factors Influencing BTC's Price

PayPal Enables Crypto Payments for U.S. Merchants

PayPal has rolled out a new feature enabling U.S. merchants to accept cryptocurrency payments, including Bitcoin, directly at checkout. This integration streamlines the use of digital assets for everyday transactions, expanding payment options for businesses and tapping into the burgeoning crypto market.

The move signals a significant stride toward mainstream adoption of digital currencies, as PayPal continues to bridge the gap between traditional finance and the crypto ecosystem. By simplifying crypto payments, the platform is positioning itself at the forefront of financial innovation.

MicroStrategy Pauses Bitcoin Purchases but Stock Gains 2% Amid $2.5B Fundraising Plan

MicroStrategy halted its weekly Bitcoin accumulation streak, leaving its holdings unchanged at 607,770 BTC ($43.61B) with an average cost basis of $71,756 per coin. Despite the pause, MSTR shares climbed over 2% in premarket trading to ~$417, reflecting sustained market confidence in its crypto-heavy strategy.

The company filed an SEC Form 8-K confirming no BTC purchases last week, dispelling speculation triggered by Michael Saylor's nostalgic post referencing its landmark 2020 acquisition of 21,454 BTC at $11,654 each. MicroStrategy remains the largest corporate Bitcoin holder globally.

Capital markets activity overshadowed crypto accumulation this week as MicroStrategy announced plans to raise $2.5B through preferred stock offerings. The war chest positions the company to resume aggressive Bitcoin acquisitions when market conditions align with its treasury strategy.

Bitcoin Mining Profitability Rises 5.3% in June Amid Hashrate Decline and Price Gains

Bitcoin mining profitability climbed 5.3% in June as a combination of higher BTC prices and reduced network competition offset soaring energy costs. The cryptocurrency's 1.2% price appreciation and 6.7% drop in hashrate—the computational power securing the network—created ideal conditions for surviving miners.

Extreme summer heat across U.S. mining hubs forced less efficient operations offline, with energy prices acting as a natural selection mechanism. This Darwinian dynamic benefited remaining operators as Bitcoin's price trajectory turned decisively bullish.

The rally accelerated in July, with BTC surpassing $123,000 amid regulatory tailwinds and dollar weakness. Market participants attribute the breakout to shifting macro conditions, including potential Fed policy adjustments and growing institutional adoption.

Despite improved economics, North American public miners produced 372 fewer BTC (3,382 total) versus May. Marathon Digital led output with 713 BTC, though its market share declined alongside peers. The sector now accounts for 25.1% of global production, down from 26.3% the prior month.

Ray Dalio Advocates 15% Allocation to Bitcoin and Gold Amid U.S. Debt Concerns

Bridgewater Associates founder Ray Dalio has urged investors to allocate up to 15% of their portfolios to Bitcoin (BTC) and gold as a hedge against escalating U.S. debt levels and economic instability. The billionaire investor emphasized these assets' role in balancing portfolios during potential fiat currency devaluation.

Dalio highlighted Bitcoin's fixed supply and transactional utility but cautioned that regulatory scrutiny and privacy limitations may hinder institutional adoption. His warning comes as U.S. national debt reaches six times annual GDP, with an anticipated $12 trillion in additional borrowing looming.

The recommendation reflects growing institutional interest in crypto assets as debt hedges, despite central bank skepticism about Bitcoin's viability as a reserve currency. Dalio maintains personal BTC holdings, signaling long-term conviction in its store-of-value proposition.

Whale's 80,000 BTC Sale Triggers Market Volatility as SunnyMining Offers Passive Income Solution

A significant Bitcoin whale unloaded 80,000 BTC near market highs, creating waves of volatility and anxiety among retail holders. While institutional players continue accumulating, individual investors are increasingly seeking ways to generate yield from their holdings without selling.

SunnyMining has emerged with a novel proposition: converting held BTC into cloud mining contracts for daily passive income. The platform eliminates technical barriers by allowing direct BTC-to-hashpower conversion, offering automated daily payouts without requiring active trading or market monitoring.

The service promises institutional-grade security with multi-layer encryption, contrasting with the recent whale activity that reminded markets of Bitcoin's inherent volatility. As the ecosystem matures, such yield-generating alternatives may become increasingly attractive to long-term holders seeking to weather price fluctuations.

Metaplanet Doubles Bitcoin Holdings in Bold Treasury Shift

Tokyo-listed Metaplanet Inc. has aggressively expanded its Bitcoin treasury, purchasing an additional 780 BTC at an average price of 17.5 million yen per coin. The firm now holds 17,132 BTC worth nearly $2 billion, cementing its position as Asia's most bullish corporate Bitcoin adopter.

The acquisition aligns with Metaplanet's revised '555 Million Plan,' which supersedes its initial 21,000 BTC target. Company leadership now eyes 100,000 BTC by year-end and 210,000 BTC by 2027—a strategy mirroring MicroStrategy's successful playbook in the U.S. market.

Investors have rewarded the bold move, sending Metaplanet shares up 5% following the announcement. The firm's Bitcoin holdings now show a 449.7% year-to-date yield, outperforming traditional cash reserves and most equity investments.

Sequans Expands Bitcoin Treasury with $88.5 Million Purchase, Now Holds 3,072 BTC

Sequans Communications, a leader in cellular IoT semiconductors, has bolstered its Bitcoin holdings with a fresh purchase of 755 BTC worth $88.5 million. The acquisition, executed at an average price of $117,296 per bitcoin, brings its total stash to 3,072 BTC—valued at approximately $358.5 million.

The company funded the latest buy using net proceeds from its July 7 public offering. Sequans has also secured $384 million through a private placement of convertible debt and equity, earmarked for further Bitcoin accumulation. Its partnership with Swan Bitcoin underscores a strategic focus on institutional-grade treasury management.

Corporate Bitcoin adoption continues gaining momentum in 2025, with Sequans emerging as a notable player among public companies holding BTC as a reserve asset. The firm’s average purchase price of $116,690 reflects disciplined accumulation amid volatile markets.

MARA Raises $900 Million to Boost Bitcoin Mining Power

Marathon Digital Holdings (MARA), a publicly traded Bitcoin mining company, has secured $900 million in funding to expand its BTC reserves and mining operations. This capital injection underscores institutional confidence in Bitcoin's long-term value proposition and solidifies MARA's position as a key player in the mining sector.

The raised funds are expected to be allocated toward two primary objectives: scaling mining infrastructure and direct Bitcoin acquisitions. This strategic move comes as Bitcoin regains momentum, with institutional investors increasingly viewing crypto assets as a viable component of diversified portfolios.

Marathon's aggressive expansion strategy may catalyze similar initiatives across the mining industry, potentially accelerating hash rate growth and further institutional adoption of digital assets. The company's ability to raise substantial capital during a period of market recovery signals renewed investor appetite for cryptocurrency exposure.

Bitcoin Hashrate Reaches Record High Amid Surging Miner Activity

Bitcoin's computational power has achieved an unprecedented peak, with its hashrate climbing to a historic high. This milestone underscores escalating competition among miners and reinforces the network's security infrastructure. The cryptocurrency's price trajectory mirrors this ascent, currently trading at $118,900—a 0.65% daily gain.

Mining pools dominate the landscape, with Foundry USA commanding 30.38% of network share. AntPool and F2Pool follow closely, while ViaBTC and SpiderPool complete the top five. Notably, block fee revenues show signs of contraction, with ViaBTC experiencing a 20.95% decline.

While heightened hashrate bolsters Bitcoin's resistance to potential 51% attacks, regulatory scrutiny intensifies as network power grows. The symbiotic relationship between miner confidence and market valuation continues to shape Bitcoin's ecosystem.

JPMorgan Upgrades MARA Holdings, Adjusts Bitcoin Miner Ratings Amid Market Shifts

JPMorgan reshuffled its ratings on Bitcoin mining stocks, upgrading Marathon Digital Holdings (MARA) to overweight while cutting Iris Energy (IREN) and Riot Platforms (RIOT) to neutral. The bank cited shifting preferences toward pure-play operators as Bitcoin's price rally improves mining profitability.

Marathon's price target was raised to $22 from $19, implying 30% upside. CleanSpark (CLSK) remains JPMorgan's top pick with a $15 target, while unrated Cipher Mining (CIFR) received a $6 objective. "Pure-play operators offer the best relative value in a rising Bitcoin environment," analysts noted.

Bitcoin traded near $118,700 as the adjustments reflect updated network hashrate data and Q2 earnings. Miner targets were lifted across the board to account for improved crypto market conditions.

Sequans Communications Expands Bitcoin Holdings to 3,072 BTC, Totaling $358.5M

Sequans Communications has bolstered its corporate treasury with an additional 755 bitcoins, bringing its total holdings to 3,072 BTC. The semiconductor firm invested approximately $88.5 million in the latest purchase, averaging $117,296 per bitcoin including fees. This acquisition was funded entirely by proceeds from an equity offering completed earlier this month.

The Paris-based company, specializing in 4G and 5G chips for IoT devices, has designated bitcoin as its primary treasury reserve asset. Sequans employs a strategic approach, utilizing capital from equity and debt raises, operational cash flow, and IP licensing to steadily accumulate more bitcoin over time.

With its total bitcoin investment now standing at roughly $358.5 million based on current market prices, Sequans holds approximately 0.17% of the total bitcoin supply. The company's aggressive accumulation strategy underscores growing institutional confidence in bitcoin as a long-term store of value.

Is BTC a good investment?

Based on current data, BTC presents a calculated opportunity:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +0.17% premium | Mild bullish |

| MACD | Positive crossover | Upward momentum |

| Bollinger Bands | Middle band hold | Neutral range |

| News Sentiment | Institutional accumulation | Long-term bullish |

John advises: 'While technicals suggest upside potential, investors should dollar-cost average given volatility from whale movements and macroeconomic concerns highlighted by Ray Dalio.'

- Technical Strength: MACD bullish crossover and MA support suggest near-term upside

- Institutional Demand: Corporate treasury purchases (Metaplanet, Sequans) offset whale sales

- Mining Health: Record hashrate and fundraising indicate network confidence